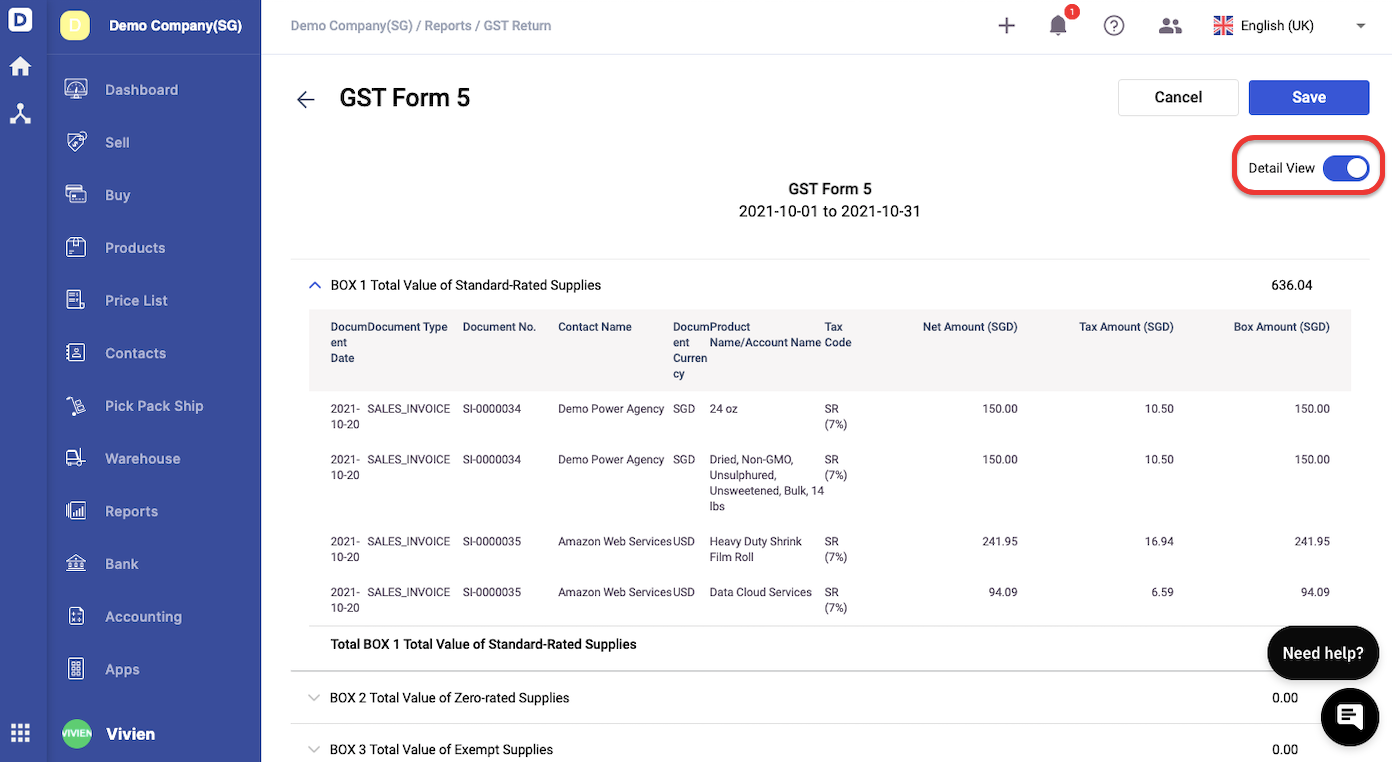

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Be able to produce the GST-03 either on a monthly or quarterly basis.

The Latest Enhancements To The Canadian Gst Hst Return Xero Blog

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

. Where annual taxable supplies are between 1500000 and 6000000 GSTHST is required to be filed quarterly and where taxable supplies are 1500000 or less an annual reporting period would be permitted. Businesses that are registered under gst have to file the gst returns monthly quarterly and annually based on the. Facilitate issuance of Tax Invoices Credit and Debit notes Have the relevant GST tax codes available for use with transactions.

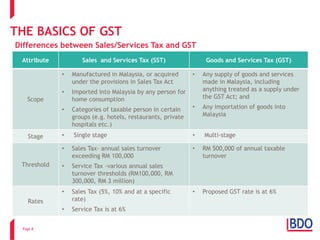

The GST lasted for three years and was later on replaced and transited to the SST policy from 1 st September 2018. However it was started way before SST in April 2015 and was governed by the Goods and Services Tax Act 2014. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

Business owners are responsible for collecting sales tax from customers and then remitting it back to the state either monthly or quarterly. Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company. Malaysias GST was administered by the Royal Malaysian Customs Department.

Be able to produce the GST Audit File when requested by Customs. In determining this threshold income arising from the supply of capital assets of the business which was previously excluded will now fall within the RM500000 threshold unless the capital assets are supplied or transferred as a result of the cessation of the business. Taxable period is a regular interval period where a taxable person is liable to account and pay to the government his GST liability.

Creating monthly or quarterly gst return 03 automatically. Goods and Services Tax GST is a broad-based consumption tax levied on the import of goods and services as well as nearly all supplies of goods and services in Malaysia except for zero-rated exempt supplies. A retrospective By Senthuran elalingam GST Partner Deloitte Malaysia.

GST comprises all businesses retailers and trades. GST returns must be submitted to the GST office not later than the last day of the following month after the end of the taxable period. Malaysia Myanmar New Zealand Philippines Singapore South Korea Sri Lanka Taiwan Thailand Vietnam PwC contacts Global VAT Online 3 4 5 10 31 43 59 75 88 105 115 136 146 166 186 202 219 236 254 270 286 289.

For consumer items such as food and beverage and retail we can expect prices to be slightly lower around 3 from the savings of input costs. GST is a multi-level tax system for most businesses and industries including manufacturers distributors retailers and consumers. The existing standard rate for GST effective from 1 April 2015 is 6.

GST is also chargeable on the importation of goods and. Goods and Services Tax GST is a multi-stage tax on domestic consumption. However a registrant may apply to be placed in other taxable period monthly or 6 monthly subject to specific conditions as follows.

As for the frequency it depends on the annual turnover of the company. What does GST mean for a Malaysia company. However 22 months on we are starting to see this process become far more routine as businesses become more familiar with the tax.

USA GST rates 2021. Our list of accounting value-added services include GST monthly or quarterly submission to Customs. Actually existing goods and service tax gst system is replaced.

Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. In a statement AmBank Group chief economist Anthony Dass shared. Annually possible subject to conditions Monthly Range from 1 to 15 days monthly or quarterly When is.

The ease with which many of these tasks can be done has also improved with the RMCD offering electronic options for filing Malaysian GST. Requirement of gst registration and. The current browser does not support Web pages that contain the IFRAME element.

GST covers a wide range of targets from manufacturers selling products to dealers reselling them to retailers and then reselling them to consumers at every stage. Some of the Malaysians are expecting prices of goods to drop while others believe otherwise. For GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

The standard taxable period is on quarterly basis. For annual turnover below RM5 million the frequency of filing is quarterly. GST Tax Codes Malaysia Changes to GST 2018 GST zero rated Setting GST to 0 in Sage 300 Sage 300 checklist for GST at 0 Sales Services Tax 2018 Setting up for SST in Sage 300 Create new Tax Authority for SST Setup Tax Classes for SST Setup Tax Rates for SST Sage 300 Malaysian SST reports.

Those companies that are achieving annual turnover above RM5 million the filing frequency will be increased to monthly. Understanding this we provide very flexible packages for our clients to decide what is best for them when considering fees and service. What is the impact of the change of gst to sst in malaysia.

In some countries GST is known as the Value Added Tax VAT. Unlike VAT or GST. Supplies made between 1 June and 1 September 2018 are liable to zero GST and should be reported as normal in the quarterly or monthly GST return The final GST return should be filed by 1 September 2018 GST audits and reviews will continue to 2019.

This will bode well for the retail business. Below is a summary of the points for taxpayers to consider during the transition period. The standard taxable period is on quarterly basis.

Malaysian businesses are required to register for GST when their turnover threshold hits RM500000. GST returns must be submitted to the GST office not later than the last day of the following month after. A GST compliant accounting software has to have the following features.

The tax return is deemed to be a notice of assessment and is.

Gstn Enabled New Options For Quarterly Returns Monthly Payment Scheme On Gst Portal A2z Taxcorp Llp

1 Gst Charge At Each Level Of Supply Chain Source Royal Malaysian Download Scientific Diagram

What Is Gst And How Does It Work Infographic Xero Sg

Gst Council Appointed Gom To Meet On June 17 Likely To Discuss Gst Rate Rationalisation A2z Taxcorp Llp

Filing Your Gst Return Gst Guide Xero Sg

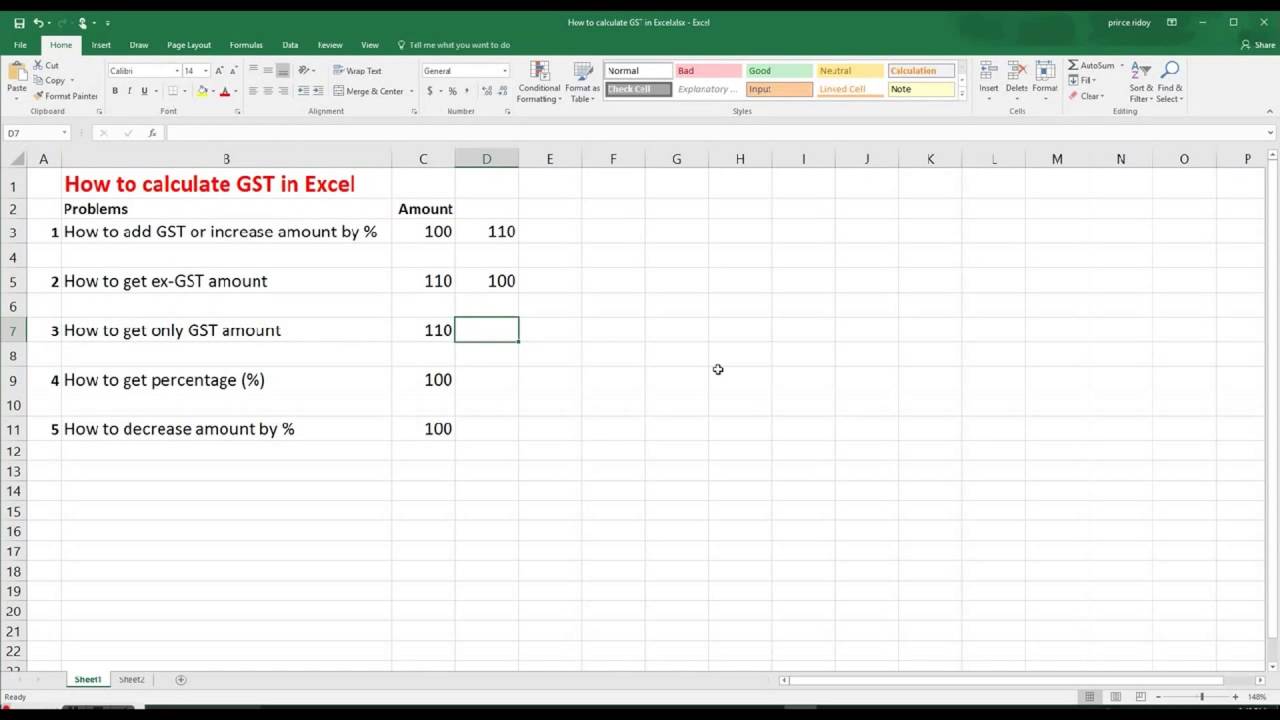

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gstn Enabled New Functionality W R T Liability Paid Percentage On Gst Portal A2z Taxcorp Llp

Gst Man Team Manager Goods And Services Tax Network Linkedin

Online Tax Consultant Gst Return Filing Service In Local Company Id 22741010533

Comparison Of Tax Rates Pre And Post Gst No Of Enterprises In Download Scientific Diagram

The Latest Enhancements To The Canadian Gst Hst Return Xero Blog

Filing Of Gst Return Video Guide Youtube

Due Dates For Gst Returns Types Of Gst Returns Ebizfiling

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help

Gst Return Forms Different Types Of Gst Returns In India Ebizfiling

Qrmp Scheme Quarterly Return Filing Monthly Payment Of Taxes